Salmon Launches Affiliate Program to Empower Filipino Creators and Expand Financial Access

Salmon, a leading fintech company in the Philippines, has launched a new affiliate program that gives content creators an exciting way to earn, while supporting the company’s mission to make financial services more accessible to Filipinos.

Through the program, creators can earn up to PHP 500 for every approved Salmon Credit referral. At the same time, they help more Filipinos gain access to a flexible revolving credit line they can use for everyday expenses.

The program is open to all types of creators, from TikTok micro-influencers to established YouTubers. There are no niche requirements and no complicated setup. Interested creators simply need to sign up at salmon.ph/affiliate?utm_source=pr and submit links to their social media pages or websites. Once approved, they can start earning right away by sharing their unique referral link with their audience.

Fueling the Local Creator Economy

Since its launch in October, Salmon’s affiliate platform has already attracted around 2,000 creator registrations, highlighting strong interest from the Filipino creator community.

As the first affiliate program in the Philippine consumer finance space, Salmon’s initiative is designed to support and empower the growing creator economy. It offers a transparent, simple, and reliable earning opportunity for creators looking to build additional income streams.

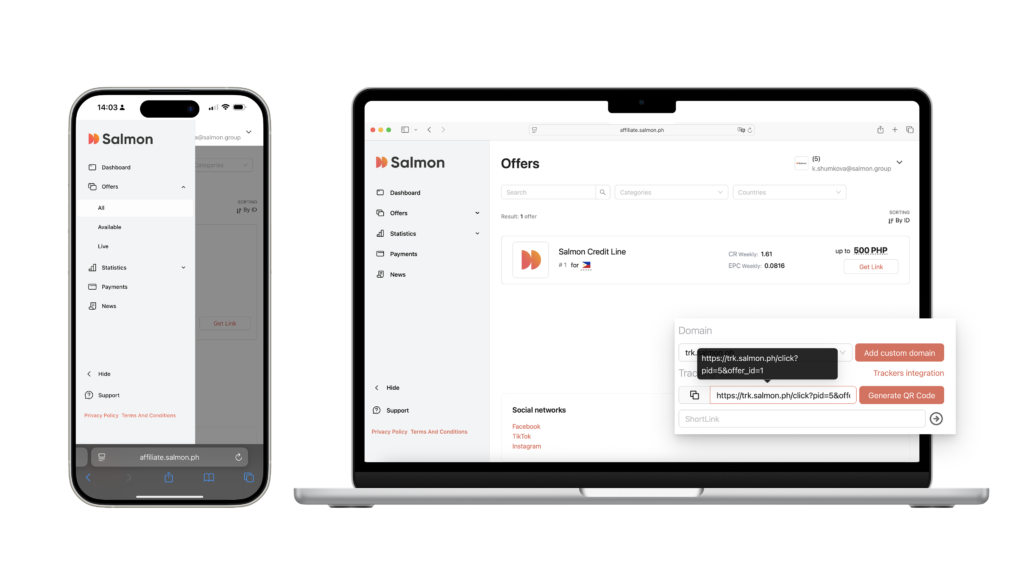

The platform also features a real-time dashboard that allows creators to track clicks, approved referrals, and earnings instantly. Monthly payouts provide a steady, dependable source of supplemental income.

Making Reliable Financial Products More Accessible

Beyond earning potential, joining the affiliate program allows creators to take part in Salmon’s broader goal of expanding access to trustworthy financial solutions for Filipinos.

Salmon Credit offers a flexible revolving credit line of up to PHP 250,000, helping users manage everyday needs—from emergency expenses and bill payments between paydays to larger purchases such as gadgets or creator equipment.

Customers can buy what they need now and pay later, with a grace period of up to 62 days. Those who pay in full by the next cut-off date can even enjoy 0% interest on their purchase*, making credit more manageable and accessible.

According to Salmon Co-Founder Raffy Montemayor, creators play a vital role in driving financial inclusion.

“Creators shape conversations and inspire communities, which is why we’re excited to partner with them to make trusted financial products like Salmon Credit more accessible. Through this platform, we’re building genuine partnerships that create real impact—unlocking new income opportunities for creators while helping drive financial inclusion in the Philippines,” he said.

Terms and Conditions apply. Salmon Credit is a product offered by Sunprime Finance Inc. LoanOnline, powered by the Salmon app, serves as the online lending platform for Sunprime Finance, Inc., a licensed financing company regulated by the SEC with CA No. 1241 and CR No. CS201916698.

You might also like

More from News

Digital Walker Launches Cosmic Box: A Tech-Powered Mystery Unboxing Experience This February!

Tech shopping just got a whole lot more exciting. This February, Digital Walker is launching Cosmic Box, an exclusive blind …

UNISOC Released the New-generation 5G RedCap Platform V527 to Accelerate the Global Extensive Application of 5G

Recently, UNISOC officially launched its next-generation high-performance 5G RedCap IoT communication chipset, the V527. As UNISOC second-generation flagship RedCap platform, …