In Southeast Asia, insurers are grappling with the challenge of attracting Gen Z—a generation known for its financial savvy and strong desire for financial security. However, despite these traits, traditional insurance products often fail to resonate with them due to their perceived complexity and a general distrust of conventional financial institutions. This disconnect is particularly evident in the Philippines, where despite a projected compound annual growth rate (CAGR) of 9.5% which will see the country’s insurance industry’s value grow to P 209 billion in 2028, actual insurance penetration remains low at 1.6%.

This shows how the industry must address the concerns of Gen Z, a demographic that McKinsey predicts will comprise a quarter of the Asia Pacific’s population by 2025, including around 40 million Filipinos (34.7% of the Philippine population).

Many Gen Z individuals feel that insurance is unnecessary at their age, preferring to focus on immediate experiences rather than long-term financial products. A study by EY found that nearly 40% of Gen Z are worried about making the wrong choices with their money. Further compounding the issue, a survey by Accenture revealed that 52% of Gen Z in Southeast Asia do not trust traditional insurers, fearing hidden clauses and high premiums.

To bridge this gap, insurers must adopt innovative strategies that resonate with Gen Z’s preferences. Regional award-winning insurtech Igloo emphasizes that this approach is vital for boosting insurance penetration in Southeast Asia. Here are some tips for effectively engaging this unique demographic:

Make insurance simple and affordable

Insurance products are often seen as complex and confusing, which can turn off younger consumers. To counter this, insurers should focus on offering straightforward policies with clear terms and conditions. Microinsurance, which provides affordable coverage for specific, smaller-scale risks, can be especially appealing to Gen Z. This generation may not have substantial financial resources but still needs protection.

Microinsurance policies can be tailored to cover travel mishaps, gadget protection, or event cancellations at affordable premiums. In the Philippines, Igloo offers products like Travel Master for travel enthusiasts to protect them health emergencies, flight delays and cancellations and Pet Insure, which provides three-in-one coverage package including reimbursements for veterinary care, owner’s liability coverage, and personal accident coverage for dog owners, ensuring that their pets a living their best lives.

By offering these targeted and relevant solutions, insurers can demonstrate an understanding of Gen Z’s priorities and financial constraints, fostering a stronger connection with this demographic.

Meet your Gen Z customers where they are

This generation values convenience and expects services to be integrated into their digital lifestyles effortlessly. By embedding insurance within products or services that Gen Z already uses and trusts—such as offering gadget insurance at the point of purchase of a mobile phone or laptop, for example—insurers can streamline the purchase experience. Insurance then becomes more relevant to the consumer, making it a natural part of their purchasing decisions, rather than an afterthought.

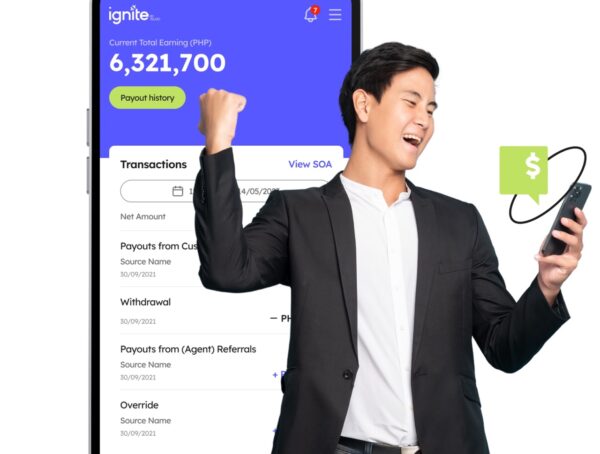

Moreover, embedding insurance in relevant contexts enhances its perceived value and relevance to Gen Z. Insurers can integrate insurance options into digital wallets or payment apps, making it easier for Gen Z to purchase them. Igloo, for instance, has collaborated with prominent regional fintech players like GCash in the Philippines, DANA in Indonesia, and ZaloPay in Vietnam, integrating their insurance products into platforms that Gen Z consumers are accustomed to.

Through embedding insurance, insurers demonstrate the value of protection in scenarios that resonate with Gen Z’s experiences and priorities, positioning insurance as a supportive and proactive solution in their daily lives.

Gamify insurance to make it fun and rewarding

Gamification involves incorporating game design elements into non-game contexts to enhance user engagement, enjoyment, and motivation. For insurers, this means transforming routine tasks like policy management and claims processing into interactive activities, creating a more appealing experience for younger consumers.

Insurers can offer points, badges, and other incentives for behavior, which will work well for Gen Z who are motivated by rewards and recognition. For example, users can earn points renewing policies, referring friends, or completing a task. These points can then be redeemed for rewards, creating a sense of value and appreciation. This approach not only incentivizes engagement but also builds a loyal customer base.

Gamification can also address the complexity issues Gen Z faces with traditional insurance products by simplifying it through interactive tutorials, quizzes, and simulations. Users can complete these educational modules and earn rewards, making the learning process both informative and engaging.

Igloo believes insurers targeting Gen Z in Southeast Asia must simplify insurance, making it accessible and rewarding. By aligning with Gen Z’s preferences, insurers can build trust and loyalty while expanding insurance penetration.

You might also like

More from News

Digital Walker Launches Cosmic Box: A Tech-Powered Mystery Unboxing Experience This February!

Tech shopping just got a whole lot more exciting. This February, Digital Walker is launching Cosmic Box, an exclusive blind …

Salmon Launches New Affiliate Program! Get Up to PHP 500 for Every Successful Referral

Salmon Launches Affiliate Program to Empower Filipino Creators and Expand Financial Access Salmon, a leading fintech company in the Philippines, has …